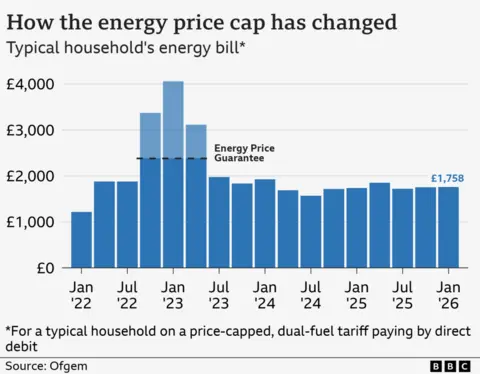

Millions of households across England, Scotland, and Wales are facing a slight increase in their energy bills as the new year commences, following regulator Ofgem’s decision to raise its energy price cap. This adjustment, effective from January, means that those on standard variable tariffs will see prices climb by 0.2%, translating to an additional £3 per year for a household consuming a typical amount of gas and electricity. This modest rise comes at a critical time, coinciding with the coldest months of the year when heating demands are at their peak, adding another layer of financial pressure for many already struggling with the broader cost of living crisis.

Campaigners and consumer advocates have quickly voiced their concerns, highlighting that even a small increase can be significant for households battling persistently high energy prices. For many, this marks another winter burdened by escalating costs, despite the seemingly minor percentage rise. The timing is particularly unwelcome, as colder temperatures across the UK necessitate greater energy consumption for heating, making any upward movement in prices acutely felt. However, a glimmer of hope exists on the horizon, with changes announced in the recent Budget expected to bring about a more substantial reduction in energy costs from April.

Ofgem, the independent energy regulator for Great Britain, plays a crucial role in safeguarding consumers by setting the energy price cap. This cap determines the maximum price that energy suppliers can charge per unit of gas and electricity for customers on standard variable tariffs, which account for the vast majority of households. It is vital to understand that the price cap limits the unit rate, not the total bill. Consequently, households that consume more energy will inevitably pay more, irrespective of the cap. Ofgem’s calculation for a "typical" household, which serves as the benchmark for illustrating the cap’s impact, assumes an annual usage of 11,500 kWh of gas and 2,700 kWh of electricity, with a single dual-fuel bill paid by direct debit. For such a household, the annual bill will incrementally rise from £1,755 to £1,758.

However, the reality of energy consumption varies drastically between households due to factors like property size, insulation quality, number of occupants, and appliance usage. Therefore, the most accurate way for individuals to assess the change is to calculate the percentage increase based on their own historical annual energy usage. The primary drivers behind this latest increase are the standing charges – the fixed daily costs that cover expenses such such as maintaining the energy network and government environmental and social levies. These charges are set to rise by 2% for electricity and 3% for gas. While there is a slight fall in gas unit rates, this is offset by an increase in electricity unit rates, meaning that homes with higher electricity usage will experience a more pronounced impact from this adjustment.

The energy sector in Northern Ireland operates under a separate regulatory framework, meaning this specific price cap adjustment applies exclusively to England, Wales, and Scotland. For consumers seeking to mitigate the impact of fluctuating variable tariffs, Ofgem and consumer groups often recommend exploring fixed-rate tariffs. These tariffs lock in the unit price of energy for a predefined period, typically 12 or 24 months, offering predictability and potentially lower costs if market prices rise. Anyone already on such a fixed deal will not be affected by this latest change to the price cap. Emily Seymour, the energy editor at the influential consumer group Which?, advises bill payers to actively search for fixed deals that are cheaper than the current price cap, ideally not exceeding 12 months in duration, and crucially, without prohibitive exit fees. This proactive approach can help consumers secure better value and greater certainty over their energy outgoings.

As January and February unfold, the UK typically experiences its coldest weather, with recent forecasts including warnings for snow and ice across various regions. This necessitates longer periods of heating for many households, directly correlating with higher energy consumption and, consequently, larger bills. In recognition of the additional strain this places on vulnerable individuals, several support mechanisms are in place. Certain eligible households in England, Wales, and Northern Ireland may qualify for Cold Weather Payments, a lifeline worth £25 a week, triggered when the average temperature in a local area is recorded or forecast to be 0°C or below for seven consecutive days. The government provides an online service for checking eligibility, while Scotland operates its own distinct Winter Heating Payment scheme, providing a set payment regardless of specific temperature thresholds.

Further governmental support includes the Warm Home Discount, which provides a £150 rebate on energy bills. The government recently extended the eligibility criteria for this scheme, aiming to assist a greater number of lower-income households with their winter heating costs. Despite these measures, organizations like the End Fuel Poverty Coalition argue that more comprehensive action is required. Simon Francis from the coalition emphasized that "every little hurts," referring to the cumulative impact of even small price rises, and called for not only significantly lower bills but also long-term strategies to improve home energy efficiency and ensure warmer homes every winter.

The stories of individual households underscore the pressing need for support. James Jones and his wife Christine, like millions of other pensioners, have welcomed the reinstatement of their Winter Fuel Payment following a government U-turn on previous restrictions. "Obviously we’ve got it for the cold months. We’ve got the central heating on more. It’s made a big difference. You know it’s coming, so it’s your standby," Mr. Jones shared, highlighting the payment’s crucial role in managing their heating costs. Despite this, the Warrington couple still finds themselves making difficult choices, cutting back on non-essential expenditures to cover their essential bills. Mr. Jones articulated a common sentiment among pensioners: "We get a rise on our pension but it gets taken off you by food, petrol and everything else going up all the time so really you don’t benefit." Their experience illustrates the ongoing struggle faced by many who, despite receiving some support, find their financial gains eroded by relentless inflationary pressures across various sectors.

Looking further ahead, there is a more optimistic outlook for spring. During the last Budget announcement, Chancellor Rachel Reeves outlined plans to reduce certain levies currently placed on energy bills. These changes, set to take effect from April, are projected to lower annual bills for millions of households by approximately £150. This initiative involves the removal of schemes designed to tackle fuel poverty and reduce carbon emissions from direct energy bills, with some costs being shifted onto general taxation. The government has confirmed that even customers on fixed deals in April will benefit from these adjustments. However, it is important to note that about £30 of these anticipated annual savings will be redirected to cover the costs of maintaining the vital gas networks and strengthening the electricity transmission infrastructure, slightly reducing the overall benefit.

Adding to the positive projections are signs of declining wholesale energy costs – the prices suppliers pay for gas and electricity before it reaches consumers. Energy consultancy Cornwall Insight, a respected authority in the sector, predicts an encouraging 8% drop in the energy price cap in April. This would equate to an annual saving of approximately £138, bringing the typical household bill down to around £1,620. This forecast is underpinned by a combination of factors, including a relatively milder winter so far, robust global gas supplies, and increasing contributions from renewable energy sources. While the immediate future brings a slight increase, the broader outlook for the spring offers a degree of relief, with market dynamics and government policy aligning to potentially ease the financial burden on households. Nevertheless, the call from campaigners for sustained, long-term solutions to ensure energy affordability and combat fuel poverty remains as pertinent as ever.