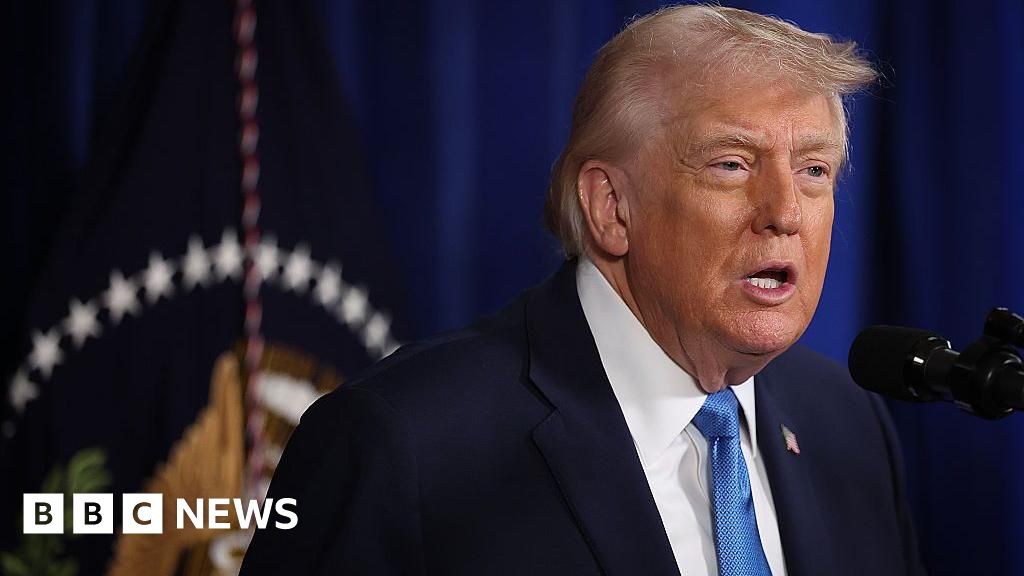

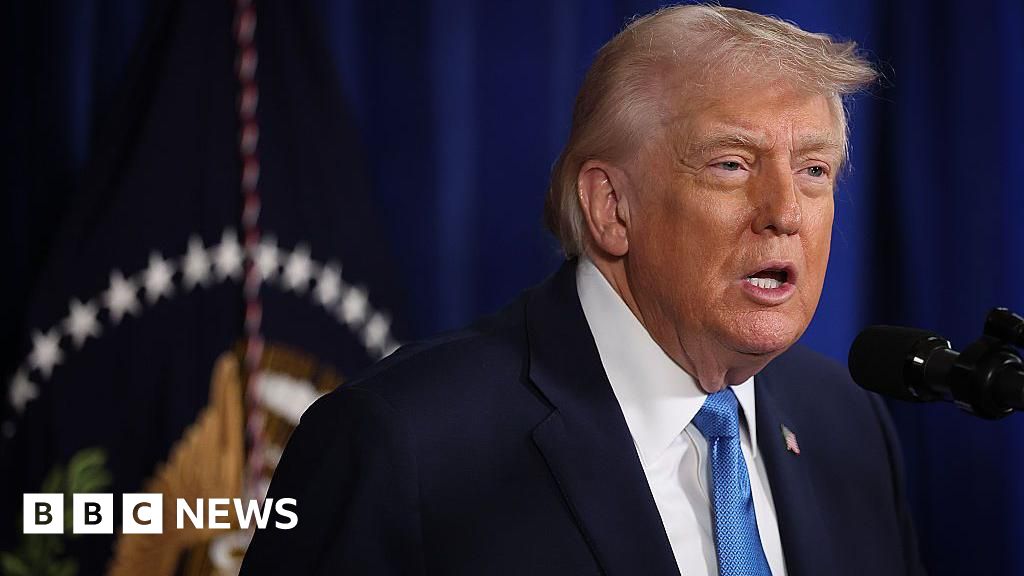

In a significant announcement that underscores a dramatic shift in US-Venezuela relations, President Donald Trump declared that Venezuela is poised to transfer a substantial quantity of crude oil to the United States. This declaration follows a US military operation that culminated in the removal of President Nicolás Maduro from power, a move with profound geopolitical and economic implications for the region. Trump stated that the interim authorities in Venezuela would be "turning over" between 30 and 50 million barrels of high-quality, sanctioned oil, an estimated value of approximately $2.8 billion (£2.1 billion).

The oil, according to President Trump, will be sold at its prevailing market price. Crucially, he added that the funds generated from these sales would be directly controlled by him, in his capacity as President of the United States. The stated purpose for this control is to ensure that the money is utilized to benefit both the people of Venezuela and the United States. This assertion was made via a post on Truth Social on Tuesday, providing the first concrete details of the economic fallout from the recent military intervention.

This move comes hot on the heels of previous statements from President Trump, who had expressed confidence that the US oil industry could swiftly revitalize Venezuela’s crippled energy sector. He had previously projected that US oil operations in Venezuela would be "up and running" within 18 months, anticipating a massive influx of investments into the resource-rich but economically devastated South American nation. However, analysts who had previously engaged with the BBC cast a more cautious outlook on such ambitious timelines, suggesting that restoring Venezuela’s once-formidable oil output could demand tens of billions of dollars and potentially a full decade of sustained effort. The scale of the challenge underscores the deep-seated issues plaguing Venezuela’s oil infrastructure, which has suffered from years of underinvestment, mismanagement, and the crippling effects of international sanctions.

The political landscape in Venezuela has undergone a seismic shift, directly preceding Trump’s oil announcement. Just a day prior, Delcy Rodríguez, formerly a prominent figure as Venezuela’s vice-president under Maduro, was sworn in as the country’s interim president. This development follows the dramatic removal of Nicolás Maduro, who has reportedly been brought to the United States to face severe charges related to drug-trafficking and weapons. The rapid transition in leadership and the immediate focus on oil assets signal a new era for Venezuela, one heavily influenced by US strategic interests.

President Trump further articulated the rationale behind US involvement in a Monday interview with NBC News, stating, "Having a Venezuela that’s an oil producer is good for the United States because it keeps the price of oil down." This statement highlights the dual objectives of the US policy: securing energy resources and potentially influencing global oil markets. The BBC’s US partner, CBS, reported that representatives from major US petroleum companies were scheduled to meet with the Trump administration this week, indicating a concerted effort to lay the groundwork for future energy investments and collaborations in Venezuela.

Despite the administration’s optimistic pronouncements, industry analysts remain largely skeptical regarding the immediate impact of Trump’s plans on global oil supply and prices. Their reservations stem from several critical factors. Firstly, international oil firms typically demand a stable and predictable political environment before committing to large-scale, long-term investments. The recent tumultuous events, even with a new interim government, may not immediately provide the necessary assurances. Secondly, even if investments were to materialize swiftly, oil exploration and production projects, especially those involving heavy crude like Venezuela’s, have lengthy lead times. Analysts caution that it would take several years, not months, before any new projects could significantly contribute to the global supply chain.

Trump has consistently argued that American oil companies possess the expertise and resources to repair and modernize Venezuela’s dilapidated oil infrastructure. Venezuela boasts the world’s largest proven oil reserves, estimated at an staggering 303 billion barrels. However, its oil production has been in a precipitous decline since the early 2000s, a consequence of chronic underinvestment, corruption, and the departure of foreign expertise. The Trump administration evidently perceives immense potential in unlocking these reserves, viewing it as a strategic opportunity to bolster America’s energy security and influence.

The process of increasing Venezuela’s oil production would undoubtedly be a costly undertaking for US firms. A significant challenge lies in the nature of Venezuelan oil itself, which is predominantly heavy crude, making it more difficult and expensive to extract, transport, and refine compared to lighter varieties. Currently, only one major US firm, Chevron, maintains operational presence in Venezuela. When asked for comment regarding Trump’s ambitious plans, Chevron spokesman Bill Turenne emphasized the company’s focus on "the safety and wellbeing of our employees, as well as the integrity of our assets," adding that they "continue to operate in full compliance with all relevant laws and regulations." This cautious statement reflects the complex and often precarious operating environment in Venezuela.

ConocoPhillips, another significant US oil company that withdrew its operations from Venezuela years ago, also offered a measured response. Spokesman Dennis Nuss stated that the company "is monitoring developments in Venezuela and their potential implications for global energy supply and stability." However, Nuss quickly added, "It would be premature to speculate on any future business activities or investments," highlighting the wait-and-see approach adopted by many potential investors. Exxon, a third major player, did not immediately respond to requests for comment, underscoring the industry’s cautious stance amidst the ongoing political and economic uncertainties.

Adding another layer of complexity to the narrative, President Trump, while justifying the removal of Maduro, asserted that Venezuela had "unilaterally seized and stole American oil." This claim was echoed by Vice-President JD Vance on X (formerly Twitter) after Maduro’s apprehension, where he wrote that "Venezuela expropriated American oil property and until recently used that stolen property to get rich and fund their narcoterrorist activities." These strong accusations suggest a historical grievance that the US is now seeking to rectify.

However, the reality of the situation, as examined by analysts, is considerably more nuanced than these claims suggest. US oil companies have a long and intricate history of operating in Venezuela, primarily through various licence and concession agreements. A pivotal moment occurred in 1976 when Venezuela nationalized its oil industry, asserting state control over its vast hydrocarbon resources. Subsequently, in 2007, under the presidency of Hugo Chávez, the Venezuelan government further tightened its grip, exerting greater state control over the remaining foreign-owned assets of US oil firms operating within the country.

This 2007 move led to significant disputes, including a high-profile case involving ConocoPhillips. In 2019, a World Bank tribunal ruled in favor of ConocoPhillips, ordering Venezuela to pay $8.7 billion in compensation for the assets it had nationalized. This substantial sum has, to date, not been paid by Venezuela, meaning at least one major US oil company has an outstanding and legally recognized claim against the Venezuelan state.

Despite these facts, BBC Verify’s Ben Chu argued that the claim that Venezuela "stole" American oil is an oversimplification. Experts clarify that the oil itself, while in the ground, was never actually owned by anyone except the Venezuelan state, which holds sovereign rights over its natural resources. The dispute primarily revolves around the expropriation of infrastructure, investments, and operational rights held by foreign companies, rather than the outright theft of the crude oil itself. This distinction is crucial for understanding the historical context and the legal complexities surrounding the US claims.

The unfolding situation in Venezuela represents a multifaceted challenge and opportunity for the United States. While the prospect of securing a vast supply of oil and influencing global prices holds strategic appeal, the practicalities of revitalizing a deeply troubled industry, navigating a complex political landscape, and addressing historical grievances will require sustained effort and careful diplomacy. The immediate transfer of 30 to 50 million barrels of oil signals a new chapter, but the long-term success of US engagement in Venezuela remains contingent on overcoming significant economic, political, and logistical hurdles.